washington state long term care tax opt out rules

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care. Visit us at wacaresfundwagov.

Your Only Chance To Opt Out Of Washington S New Long Term Care Tax Is Fast Approaching Puget Sound Business Journal

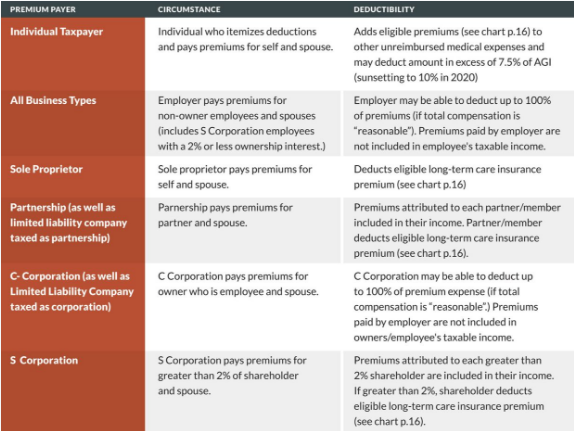

1 2022 all employees in Washington state will be subject to a new payroll tax to support the WA Cares Fund a long-term care public insurance benefit.

. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage. This 058 payroll deduction is uncapped. What You Need to Know About Washington States New Long Term Care Tax.

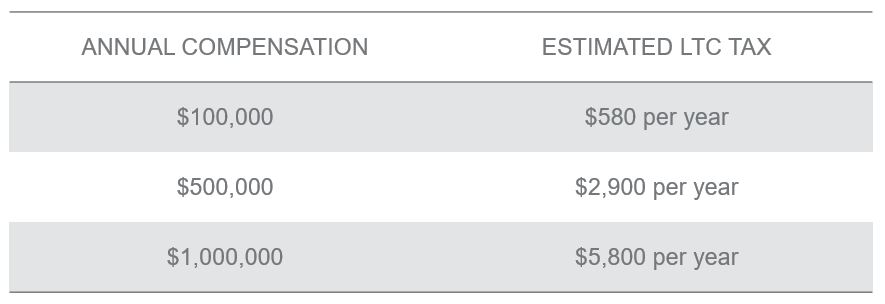

WHAT IS THE TAX. Beginning in July 2023 W2 workers including those with lower incomes struggling to make ends meet will be subject to a payroll tax of 58 cents for every 100 they make to fund a long-term care program called WA Cares. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire.

It should be repealed. On April 14 2021 the House passed an amendment to the original Bill SHB 1323 extending the deadline from July 24 2021 to November 1 2021. To opt out an individual must purchase a qualified long-term care insurance plan before Nov.

You do not need a copy of your policy to file the exemption. The tax has not been repealed it has been delayed. Employees will be required to contribute through a 058 payroll deduction with one important exemption discussed below.

In that case the tax will be permanent and mandatory. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care Program. Jul 7 In 2019 Washington debuted a pilot program to pay individuals who receive home care services a lifetime maximum benefit of about 36500 to assist with activities of daily living like in-home care transportation and other relevant needs.

Washington State Long Term Care Tax. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. The current rate for WA Cares premiums is only 058 percent of your earnings.

A qualifying long-term care insurance plan must meet the definition of long-term care insurance in. This money will cover services and support some retirees need to. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for an exemption from the program.

2062817211 phone 2062836122 fax. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of. This tax is permanent and applies to all residents even if your employer is located.

Beginning January 1 st 2022 Washington residents will fund the program via a payroll tax. Update April 16 2021. Long-Term Services and Supports LTSS is now called WA Cares Fund.

But thats what Washington states 2019 long-term care law will do. Applying for an exemption. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account.

It will allow you to opt out of the tax as long as the coverage qualifies and you obtain the opt out in accordance with Washingtons requirements. Long-Term Services and Supports LTSS Trust Act Trust Commission In 2019 the state enacted a long-term care insurance benefit for all eligible Washingtonians funded by worker contributions into a trust fund. Implementation of SHB 1732 and ESHB 1733 and Phase Three employer audits.

This means that if you purchased a private long-term care policy that you should not cancel it. The WA Cares Fund is the first of its kind in the United States and is the latest example of the states standing as a national leader in long-term care policy. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption.

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Private insurers may deny coverage based on age or health status. To apply navigate to the WA Cares Fund website and select Apply for an Exemption.

Sign up here to receive LTSS rulemaking updates. There is no indication that the opt-out period will be extended. Workers in Washington state age 18 years or older have a short window in 2021 to permanently opt out of the Trust Program and its payroll tax.

You will need to attest that you have purchased a private long-term care insurance policy before November 1 2021. Applications are available as of October 1 2021. Washington State Hospital Association 999 Third Avenue Suite 1400 Seattle WA 98104.

Another Hurdle Passed Updated. Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021. SHB 1732 delays the WA Cares Fund program by eighteen months.

For someone with annual wages of 50000 thats 290 a year in premiums. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC policy. Individuals who have private long-term care insurance may opt-out.

New State Employee Payroll Tax Law for Long-Term Care Benefits. How do I opt out of WA cares.

Ltca Long Term Care Trust Act Worth The Cost

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

The Essential Guide To Group Long Term Care Insurance

.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary).jpg)

The Private Ltc Insurance Option For Washington State Workers

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Washington Long Term Care Act Becu

Washington State Delays Public Long Term Care Insurance Until April Explores Changes

Washington State Long Term Care Tax Here S How To Opt Out

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Washington S First In The Nation Long Term Care Program Starts In January With Opt Out Deadline Soon Local News Spokane The Pacific Northwest Inlander News Politics Music Calendar Events In Spokane Coeur D Alene

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington State S New Long Term Care Payroll Tax Won T Kick In Until Next Year Benefits In 2026 Oregonlive Com

Washington Long Term Care Resources Ltc News

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors

Kuow Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time

Making Sense Of Washington S New Long Term Care Law Parker Smith Feek Business Insurance Employee Benefits Surety